Why Choose GA Hard Money Lenders for Your Next Real Estate Development Project

Why Choose GA Hard Money Lenders for Your Next Real Estate Development Project

Blog Article

The Ultimate Guide to Discovering the very best Difficult Cash Lenders

From reviewing lending institutions' reputations to contrasting rate of interest rates and costs, each action plays a crucial function in safeguarding the finest terms feasible. As you take into consideration these aspects, it comes to be apparent that the path to identifying the ideal hard cash lending institution is not as straightforward as it may seem.

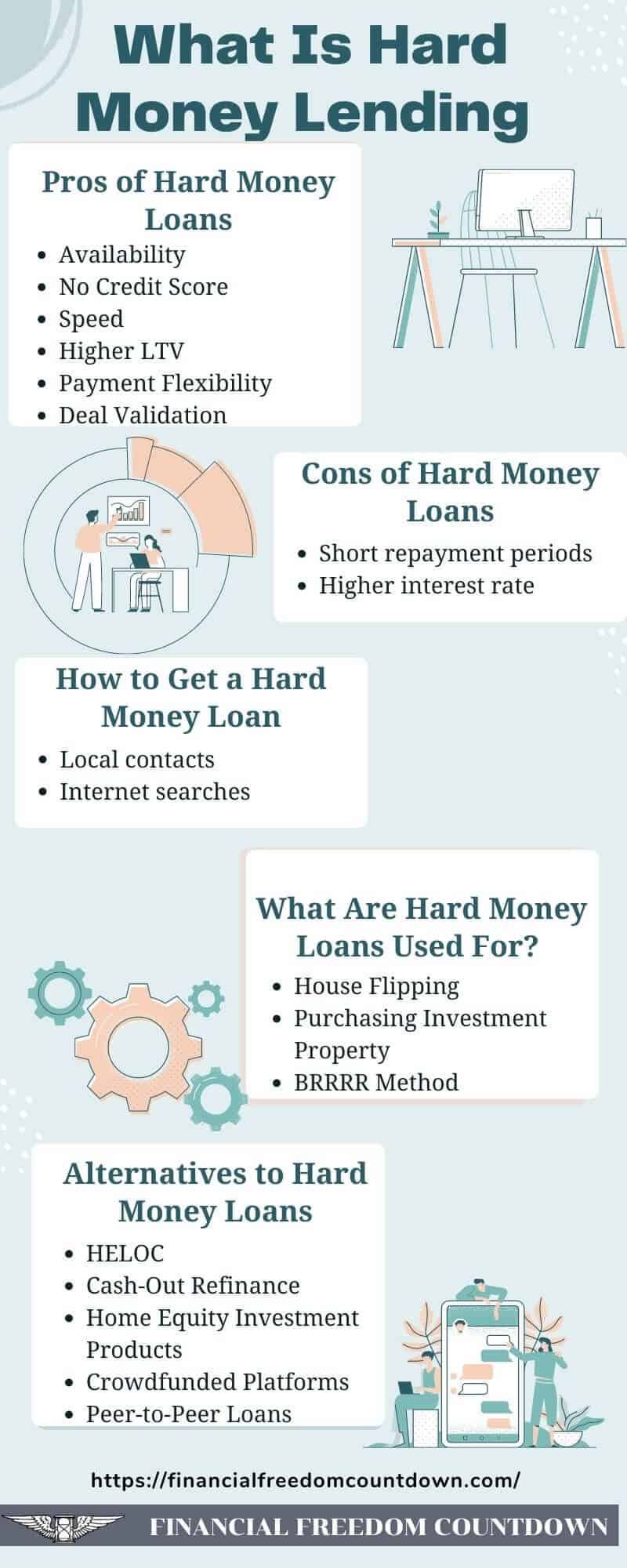

Understanding Tough Money Lendings

Among the defining functions of hard cash car loans is their dependence on the value of the property instead of the customer's credit reliability. This allows customers with less-than-perfect debt or those seeking expedited financing to gain access to funding quicker. Additionally, tough money car loans typically include greater rate of interest and shorter payment terms compared to conventional loans, showing the boosted danger taken by lending institutions.

These financings offer various functions, consisting of funding fix-and-flip jobs, refinancing troubled buildings, or giving capital for time-sensitive chances. Comprehending the nuances of difficult cash loans is crucial for investors that intend to utilize these economic tools efficiently in their real estate ventures (ga hard money lenders).

Trick Elements to Consider

Various loan providers provide differing interest prices, charges, and settlement schedules. Additionally, analyze the lender's funding speed; a quick approval procedure can be essential in affordable markets.

Another important factor is the lending institution's experience in your particular market. A lending institution accustomed to local problems can supply valuable understandings and could be a lot more adaptable in their underwriting procedure.

Just How to Review Lenders

Examining difficult cash lenders involves a systematic method to ensure you pick a partner that straightens with your investment goals. A reputable loan provider needs to have a history of successful deals and a solid network of pleased debtors.

Next, check out the loan provider's experience and expertise. Various lenders might concentrate on different sorts of buildings, such as residential, industrial, or fix-and-flip jobs. Choose a lending institution whose knowledge matches your investment approach, as this expertise can substantially impact the authorization process and terms.

Another vital variable is the lending institution's responsiveness and interaction style. A dependable lender must be willing and obtainable to address your questions adequately. Clear interaction throughout the analysis process can suggest how they will manage your finance throughout its period.

Finally, make certain that the lender is clear about their demands and procedures. This consists of a clear understanding of the documents needed, timelines, and any type of problems that may apply. When choosing a tough look what i found money lender., taking the time to assess these aspects will certainly encourage you to make an educated choice.

Contrasting Rate Of Interest and Costs

A thorough contrast of interest prices and charges among tough cash loan providers is vital for maximizing your financial investment returns. Difficult money loans usually include greater rate of interest contrasted to typical financing, normally varying from 7% to 15%. Comprehending these prices will assist you evaluate the prospective expenses related to your investment.

In addition to rate of interest, it is important to evaluate the linked costs, which can significantly affect the overall loan price. These fees might include origination costs, underwriting fees, and closing costs, typically shared as a percent of the car loan quantity. Source costs can differ from 1% to 3%, and some loan providers might bill added costs for handling or administrative tasks.

When comparing lenders, consider the overall price of borrowing, which includes both the rate of interest rates and fees. This alternative method will certainly permit you to identify the most economical options. Be sure to inquire concerning any feasible early repayment penalties, as these can affect your capacity to pay off the lending early without sustaining additional charges. Eventually, a careful analysis of passion rates and costs will result in even more informed loaning decisions.

Tips for Successful Borrowing

Recognizing rate of interest and charges is only component of the equation for securing a hard cash finance. ga hard money lenders. To make sure successful loaning, it is crucial to completely assess your economic circumstance and job the potential return on financial investment. Begin by clearly specifying your borrowing objective; lending institutions are most likely to react favorably when they recognize the designated usage of the funds.

Next, prepare a comprehensive service plan that describes your project, anticipated timelines, and financial forecasts. This shows to loan providers that you have a well-balanced technique, boosting your integrity. Furthermore, maintaining a solid partnership with your lending institution can be beneficial; open interaction fosters trust and can lead to extra positive terms.

It is also essential to ensure that your property fulfills the lender's standards. Conduct a complete evaluation and supply all called for documents to simplify the authorization procedure. Last but not least, bear in mind leave approaches to settle the lending, as a clear repayment strategy comforts lending institutions of your dedication.

Verdict

In summary, finding the very best tough money loan providers necessitates a complete examination of various aspects, consisting of lending institution reputation, car loan terms, and specialization in building types. Efficient analysis click over here now of lending institutions via contrasts of interest prices and charges, combined with a clear company plan and strong communication, enhances the probability of positive loaning experiences. Ultimately, persistent research and strategic involvement with loan providers can bring about successful economic end results in property ventures.

Additionally, hard money financings generally come with greater passion prices and shorter repayment terms contrasted to traditional fundings, showing the increased threat taken by lending institutions.

Report this page